Masters In Financial Analysis

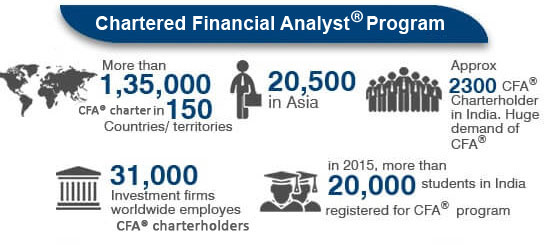

Masters in Financial Analysis is a unique program which enables you to work as an educated and trained professional in this exciting world of capital markets with all the relevant theoretical and practical knowledge. This program incorporates the curriculum of all the three levels of CFA® Program offered by the CFA Institute.

This 2 yr Master Degree Program leads you to be awarded UGC recognized Master Degree of M.Com in Financial Analysis from University of Mysore.

Program Overview

The economic liberalization has brought drastic changes in the corporate environment. Specialization has become the need of the hour. Globalized world economy, integrated markets and continuous product innovation has created an absolute need for research professionals having insightful knowledge of financial concepts.

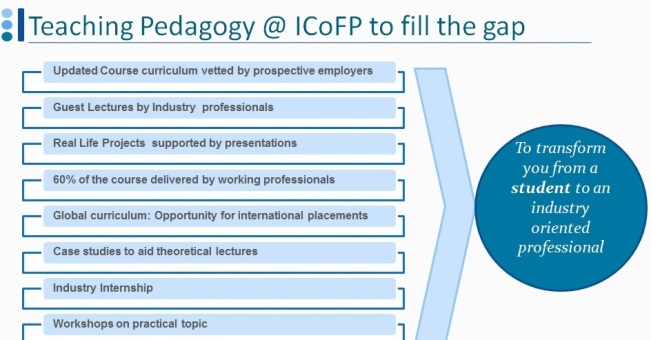

Masters in Financial Analysis is a unique combination of conceptual knowledge, practical training, skills development and simulations on softwares. Apart from classroom teaching, more emphasis will be on assignments, case studies, situation analysis, mock trading sessions, research projects and testing of the models using state of the art software’s. The main aim of the program is to create a stream of trained professionals who will become the torchbearers of the revolution in the space of Corporate Banking and Research.

Program Objectives

- Understanding global financial instruments and markets

- Management of investment portfolios to generate superior returns

- Learning the art and science of company valuation & analysis

- Learning all that it takes to clear the CFA® Program by CFA Institute, USA

- Wild card to glorified career in financial research

- To provide the students broad-based education necessary for progressing towards a leadership role in the financial sector.

- To provide students with the theoretical framework and analytical tools and techniques to handle a variety of finance and business functions.

Unique Aspects

- A UGC recognized unique industry-integrated program.

- Rich content based the Harvard systems, developed in accordance to industry requirements.

- Incorporates all three levels of the international CFA® Program.

- Detailed coverage of equity, debt, derivatives, commodities and Forex market.

- Hands-on experience on Ace Equity, state of the art capital market software.

- 22 papers including business communication and personality development.

- Three extensive research projects and six months of real industry exposure.

- Live market visits.

Career Scope

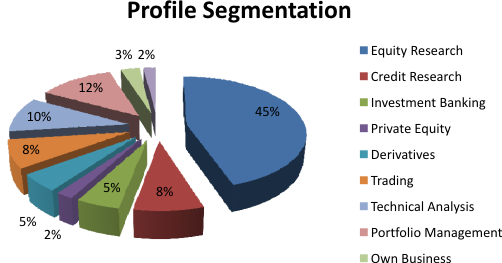

1. Portfolio Management: Portfolio managers guide institutional as well as private clients how they should allocate money into different asset classes. It’s a complicated area and requires the sound understanding of portfolio theories, quantitative techniques and risk minimizing techniques. They should also possess good interpersonal skills as they directly consult human beings. There may be 2 variations in this kind of a role:

2. Fund Management: These are the professionals who manage money under a particular scheme. They directly invest in markets on behalf of investors and try to generate high risk adjusted returns for them.

3. Equity Research: They are think tanks of capital markets. Their task is to analyze future prospects of businesses on the basis of financial & economic factors. They hunt for undervalued stocks where share prices are lower than the true economic worth of the company. They generally have specialization in a particular sector of the economy and track all news and policy changes related to it. They need to have the sound understanding of various valuation models, financial statement analysis and above all the analytical skills. Successful research analysts can see through thick layers of businesses, quantify their thoughts and take a decision that is different and accurate at the same time. Research analysts publish their thoughts through research reports in media or to specific group of investors.

4. Credit Research: Phases of financial meltdown in history has proved the importance of credit analysis function in financial institutions and rating agencies. Credit analysts perform tasks similar to that of an equity research analyst except that the end decision is to invest in the debt of a company. They try to ascertain credibility and capacity of the borrower in paying back interest and principal to lenders where borrowers can be Countries as well as Companies. They are interested in knowing strength of business, its financials, management quality etc.

5. Investment Banking: Investment Banks render high end financial services to corporate clients, such as Mergers & Acquisition, Fund Raising, IPO valuation, Debt Syndication etc. It’s a multifaceted business where deeply talented professionals get an entry ahead of competition. Investment bankers may be involved in following activities:

a. Investment Banking Research: Analysts in this part of IB try to address how a merger of different companies would fetch synergies for companies involved. They look at financial, strategic and economic benefits of the deal.

b. Deal Scouting: Professionals in this part of IB are also known as front-enders since they interact & network with top management of companies and explore investment banking needs.

c. Debt Syndication: Debt syndicators get requisite financing for big projects. Their task is similar to those who are in deal scouting. Both need to have strong interpersonal and technical skills.

d. Private Equity: Analysts in this area deal with the difficult side of IB, valuation of companies that are privately held. The challenging task requires knowledge of higher end techniques of valuation and deeper knowledge of business models.

6.Derivatives Strategy: Derivatives are the greatest and most debated innovation in financial markets in recent decades. Derivatives hold a prominent position in areas of trading, business risk management and portfolio management. Complex financial derivatives exist in almost all areas ranging from stock, debt, interest rates, commodities and currency to even monsoon and cyclones. Derivate specialists design optimum trading or risk management strategies and it requires deep knowledge about their valuation and features.

7. Trading: Traders buy and sell but efficient traders buy cheap and sell expensive. It’s a burgeoning area of employment for finance professionals. Companies having proprietary trading desk employ skilled workers who invest on company’s behalf in stocks, bonds, commodities, currencies or derivatives to earn profits. Many of the traders are just automated traders, who simply design trading strategies on the basis of their view on market, execution is done automatically by high end softwares.

8. Technical Analysis: Technical analysts are experts who taking the buy or sell decision in the basis of past movement in prices of any stock, bond, currency or commodity. They study the graphs, volumes and momentum indicators of an asset to arrive at a buy/sell decision. Most important skills include data interpretation, number crunching and statistical understanding.

9. Other: Scope of this program is vast and above mentioned profiles may be just a drop in ocean. There is possibility of employment in other areas as well, such as: Real Estate Analysis, Hedge Funds, Risk Management, Arbitrage, Currency and Commodity analysis, Quantitative Analysis, Automated Trading, and Academics etc.

Note

Program affiliated with and degree awarded by UGC Approved University

Curriculum

Program Structure Masters in Financial Analysis program incorporates complete study curriculum of one of the most respected financial qualification in the world, Chartered Financial Analyst® (CFA® Program). It includes all 3 levels of CFA® USA along with select India specific topics. The innovative program structure of Masters FA program has been acknowledged as incorporating CFA (US) Program Candidate Body of Knowledge (CBOK). Masters in Financial Analysis offers the most extensive and robust curriculum based on the Harvard Systems, making our students the preferred choice of the recruiters.

The Innovative Program Structure: Multiplying Your Opportunities:

Program Content

Just like other professional skills, professional ethics are a prerequisite for finance professionals. This topic presents the framework of ethical conduct given by CFA Institute of America in addition with principles of corporate governance.

2. Security Analysis-1: This unit is divided in four parts:a. Equity Analysis: One of the most rewarding & challenging tasks in world of finance is equity research. This topic sets the foundation for deeper study as it starts with intro of equity market terminologies and goes into industry & company analysis techniques. Finally it talks about fundamental and relative valuation techniques, which we shall study in great details later.

b. Debt Analysis: This topic covers analysis of fixed income instruments, one of the largest and fastest growing segments of global financial markets. It covers characteristics & risks involved in fixed income instruments, structure of global bond markets and analysis of fixed income yields & spreads.

c. Alternate Investment Analysis: Universe of alternate investments is huge and full of innovation. Topic introduces types, features, risks & return of various alternate investments such as property, commodities, private equities, hedge funds, ETFs etc.

d. Derivative Strategies: It covers various types of derivative instruments such as forwards, futures, options, swaps etc and introduction to their application in risk management.

3. Financial Reporting & Analysis-1:It starts with basic principles of financial reporting and goes on to discuss all types of financial statements of a company. Later part covers prominent techniques to decode & analyze relevant information to facilitate decision making. Finally a topic of great practical importance is covered, convergence of accounting standards to IFRS.

4. Corporate Finance:The topic covers the principles that corporations use to make their investing and financing decisions. Initial part covers techniques of capital budgeting, measuring cost of capital & leverage. Later part covers management of working capital and dividend policies of a company.

5. Portfolio Management & Quantitative Techniques-1: This part is divided into two parts:a. Portfolio Management: Portfolio Management is one of the most researched topics in finance. This topic covers introduction to process of portfolio management, understanding client objectives & constraints & quantifying them. Finally you study the theories of portfolio management and critically analyze them in the end.

b. Quantitative Techniques: Topic presents the fundamentals of some of those quantitative techniques that are essential in almost any type of financial analysis. Topic includes advanced discussion of time value of money, discounted cash flows, statistical concepts & probability theory, all from the finance perspective.

6. Advanced Economics:Topic covers in depth study of micro & macroeconomic school of thoughts. With perspective to finance, topic covers demand-supply equilibrium, firm output decisions & costs under micro economics. The macroeconomics part explains different market structures under which firms operate and goes on to explain how at macro level GDP is determined due to aggregate demand and supply interaction, how business cycles originate and finally impact of monetary & fiscal policies on economy.

This topic is advanced extension of security analysis studied in previous semester, again is divided in four parts:

a. Equity Analysis: This study session presents additional valuation methods for estimating a company's intrinsic value, fundamental as well as relative, different approaches to research such as top-down & bottom, approach to industry analysis, valuation of emerging markets, valuation of private companies.

b. Debt Analysis: For the first time you study here about valuation of complex fixed income instruments, credit analysis, liquidity analysis, analysis of term structure of interest rates.

c. Alternate Investment Analysis: After having studied briefly about types of alternate investments, you study how to value and analyze alternate investments and manage them in your portfolio. Special focus is on Real Estate, Private Equity, Commodities & Hedge Funds.

d. Derivative Strategies: After having understood types & features of derivatives in sem 1, you will learn about pricing, valuation and application of derivatives in risk management.

2. Economics for Valuation:This topic focuses on linking thus far learnt economics concepts with valuation of securities by explaining the impact of macroeconomic environment on firm's profitability. Focus is on Growth theories, exchange rate theories & Concepts and measures of economic growth.

3. Financial Reporting & Analysis-2:In this advanced version some key issues that affect company valuations are covered in details. It covers analysis of M&A Accounting,Post-Employment and Share-Based compensation, Multinational Operations and how different accounting policies may affect analytical interpretation and how to troubleshoot it. In the end you study advanced techniques of ratio analysis & determining quality of earnings.

4. Corporate Finance & Ethical Standards:This reading is divided in 2 parts:

a. Corporate Finance: Topic covers advanced discussion on capital budgeting principles, dividend policy, capital structure policy, corporate governance and M&A strategies.

b. Ethical Standards: Except some new ethical principles, topic repeats most part of ethical standards read in sem 1, it shows great amount of importance given to this topic.

5. Portfolio Management & Quantitative Techniques-2:This reading has 2 parts:

a. Portfolio Management: Topic introduces a popular extension to Markowitz portfolio theory studied in sem 1, the Capital Asset Pricing Model and explains how to quantify & diversify portfolio risk using efficient portfolios. Later you study more theories such as theory of active portfolio management, international diversification and managing taxation to maximize post tax gains and finally constructing investment policy statement.

b. Quantitative Techniques: Topic focuses on popular quantitative tool in research, the regression analysis. It covers single, multivariable and time series regression models along with techniques to assess credibility of such tests, called ANOVA.

6. Research Project 1:Knowledge once practiced becomes wisdom. So this part is about practical application of most concepts discussed so far. The full-fledged project is based on real time issues and is made under expert guidance with access to necessary software and infrastructure.

Finance professionals are responsible for most optimum allocation of corporate resources; this topic covers various techniques to meet this goal. It complements corporate finance topic studied so far and covers introduction to financial management, cash flow estimation, financial systems in India, sources of finance etc.

2. Financial Modeling Basic and Advanced:Modeling techniques for accurate financial forecasting are heavily used in most areas of finance.Thus here we study basic & advanced financial excel to help create models for Valuation, Financial Statement Analysis, M&A, LBO and Risk Management.

3. Wealth Management:Wealth Management is an integral part of overall process of portfolio management and is important for companies as well as individuals. Here we learn to study patterns of behavioral finance, issues important in private wealth management and institutional wealth management.

4. Application of Economics in Portfolio Management:Here we study the branch of Economics that help in formulate the Capital Market Expectation and Valuation of Assets.

5. Portfolio Management Process and Execution:The topic streamlines and compliments readings done so far by formally introducing detailed process of portfolio management and execution related aspects such as Asset Allocation, ALM approach, Trading Decisions, Algorithm Trading, Monitoring, Rebalancing and Performance Evaluation.

6. Research Project-2:Knowledge once practiced becomes wisdom. So this part is about practical application of most concepts discussed so far. The full-fledged project is based on real time issues and is made under expert guidance with access to necessary software and infrastructure.

The topic discusses advanced level financial decisions taken by top management such as Debt and Hybrid Financing, Working Capital Management, Corporate Valuation, Managing Sick Units, Restructuring and Value Creation and some special topics followed by a project on the topic.

2. Fixed Income Portfolio management:Topic explains how fixed income (FI) portfolio is managed while deploying knowledge of previous readings. Approaches of FI portfolio Management such as objective only, ALM, Immunization and multiple liability management are discussed along with Relative-Value Methodologies for Global Credit Bond Portfolio and Hedging Mortgage Securities to Capture Relative Value.

3. Equity Portfolio Management & Project Work:Equity securities represent a significant portion of many investment portfolios; equity management is often a critical component of overall investment success. This session focuses on the role of equities in an investment portfolio, the three major approaches used to manage equity portfolios, and the evaluation of equity managers.

4. Financial Risk Management & Project Work:To match the increasingly complex nature of investment management, topic focuses on sophisticated risk management techniques to provide analysts with the necessary tools to properly measure the varying facets of risk including market, liquidity, credit ¤cy risk. Post measuring & modeling risk topic moves to risk management using forwards, futures, options, swaps and quantitative techniques followed by a project on the topic.

5. Alternate Investment Analysis & Project Work:Portfolio managers who take advantage of the opportunities presented by alternative investments may have a substantial advantage over those who do not. The topic initially presents an overview of the investment classes generally considered as alternative investments and then examines the role of swaps, forwards, and futures in managing certain alternative investments followed by a project on the topic.

6. Research Project-3:The full-fledged project will invite all skills learnt during the program into practice by selecting an area of practical importance that research analysts with multiple years of experience are generally working on. Such project again is made under expert guidance with access to necessary software and infrastructure.

Admissions

Course Duration

- The programme offers a perfect balance of theoretical learning and practical exposure.

- Masters in Financial Analysis is a two years full time course, which includes ‘The Real Work’ projects on site for two months.

Eligibility & Admission Process Admission Procedure:Our Masters programs are targeted towards individuals with high potential for success. Selection at ICoFP is therefore rigorous & competitive. We at ICoFP ensure that we tailor make talent for leading companies and follow their selection procedure.

Eligibility

- The candidate must possess a Bachelor’s Degree

- The Bachelor’s Degree (or equivalent qualification) with minimum of 45% obtained by the candidate must entail a minimum of 3 years of education after completing Higher Secondary School (10 + 2 or equivalent).

- Candidate applying for their final year exams can also apply subject to furnishing a proof of graduation by 15th September.

1. Application : ICoFP Prospectus and Application Form and can be acquired by one time payment of Rs. 1000/- for one program.

- By cash payment at our counseling offices.

- By post (enclosing demand draft drawn in favor of “International College of Financial Planning ltd.” payable at New Delhi).

- On-line application through click here (need to make the payment by credit/debit card).

2. Admission Test: Candidates are required to appear for ICoFP’s entrance exam (I-NET). Which measures the prospective candidates on critical areas like communication skills, logical reasoning, and quantitative skills.The candidate has to undergo a rigorous selection procedure comprising of Written Test, Group Discussion & Personal Interview. All candidates who have appeared for CAT/ MAT can also apply to ICoFP with their score. Short listed candidates will have to appear only for GD & PI. Group Discussion and personal interview are also integral components of the admissions process. The overall objective is to identify and assess the candidate’s communication ability, in addition to the overall knowledge of the student.

3. Admission Offer: Final selection will be based on a careful evaluation of the applicant’s academic record from class X, through graduation and/or post graduate qualification, work experience (if any), extra curricular activities, Group Discussion and personal Interview. Successful candidates will be informed of their final selection by courier/ phone call. The selected candidates must pay their first fee installment within two weeks of receiving the admission offer, failing which the offer will be withdrawn.

Career Opportunities

Portfolio Management: Portfolio managers guide institutional as well as private clients how they should allocate money into different asset classes. It’s a complicated area and requires sound understanding of portfolio theories, quantitative techniques and risk minimizing techniques. They should also possess good interpersonal skills as they directly consult human beings. There may be 2 variations in this kind of a role:

Wealth Management: Finance professionals involved in advisory of financial instruments to clients after establishing their holistic financial plans. They may carry responsibility to earn fee for their employer in return of high portfolio advice being given. The ostentatious profile includes diverse exposure to businesses and individuals and leads to quick development of social intellect for the professional.

Fund Management: These are the professionals who manage money under a particular scheme. They directly invest in markets on behalf of investors and try to generate high risk adjusted returns for them.

Equity Research Analyst: They are think tanks of capital markets. Their task is to analyze future prospects of businesses on the basis of financial & economic factors. They hunt for undervalued stocks where share prices are lower than true economic worth of the company. They generally have specialization in a particular sector of economy and track all news and policy changes related to it. They need to have sound understanding of various valuation models, financial statement analysis and above all the analytical skills. Successful research analysts can see through thick layers of businesses, quantify their thoughts and take a decision that is different and accurate at the same time. Research analysts publish their thoughts through research reports in media or to specific group of investors.

Credit Research Analyst: Phases of financial meltdown in history has proved the importance of credit analysis function in financial institutions and rating agencies. Credit analysts perform tasks similar to that of an equity research analyst except that the end decision is to invest in the debt of a company. They try to ascertain credibility and capacity of the borrower in paying back interest and principal to lenders where borrowers can be Countries as well as Companies. They are interested in knowing strength of business, its financials, management quality etc.

Investment Banking: Investment Banks render high end financial services to corporate clients, such as Mergers & Acquisition, Fund Raising, IPO valuation, Debt Syndication etc. It’s a multifaceted business where deeply talented professionals get an entry ahead of competition. Investment bankers may be involved in following activities:

- Investment Banking Research: Analysts in this part of IB try to address how a merger of different companies would fetch synergies for companies involved. They look at financial, strategic and economic benefits of the deal.

- Deal Scouting: Professionals in this part of IB are also known as front-enders since they interact & network with top management of companies and explore investment banking needs.

- Debt Syndication: Debt syndicators get requisite financing for big projects. Their task is similar to those who are in deal scouting. Both need to have strong interpersonal and technical skills.

Private Equity: Analysts in this area deal with the difficult side of IB, valuation of companies that are privately held. The challenging task requires knowledge of higher end techniques of valuation and deeper knowledge of business models.

Derivatives Strategy: Derivatives are the greatest and most debated innovation in financial markets in recent decades. Derivatives hold a prominent position in areas of trading, business risk management and portfolio management. Complex financial derivatives exist in almost all areas ranging from stock, debt, interest rates, commodities and currency to even monsoon and cyclones. Derivate specialists design optimum trading or risk management strategies and it requires deep knowledge about their valuation and features.

Trading: Traders buy and sell but efficient traders buy cheap and sell expensive. It’s a burgeoning area of employment for finance professionals. Companies having proprietary trading desk employ skilled workers who invest on company’s behalf in stocks, bonds, commodities, currencies or derivatives to earn profits. Many of the traders are just automated traders, who simply design trading strategies on the basis of their view on market, execution is done automatically by high end softwares.

Technical Analysis: Technical analysts are experts who taking the buy or sell decision in the basis of past movement in prices of any stock, bond, currency or commodity. They study the graphs, volumes and momentum indicators of an asset to arrive at a buy/sell decision. Most important skills include data interpretation, number crunching and statistical understanding.

Other: Scope of this program is vast and above mentioned profiles may be just a drop in ocean. There is possibility of employment in other areas as well, such as: Real Estate Analysis, Hedge Funds, Risk Management, Arbitrage, Currency and Commodity analysis, Quantitative Analysis, Automated Trading, and Academics etc.

Masters FA FAQs

Q1. What is the difference between general Masters vs Masters (FA)

Ans: It is all a matter of Specialisation. While a general Masters will give you knowledge about different facets of management, Masters FA will provide you with specialised knowledge about FINANCIAL ANALYSIS.

Q2.What portion of the CFA curriculum is covered in the Masters (FA)?

Ans: Masters FA covers 100% of the course curriculum of all the three levels of CFA® program by CFA Institute.

Q3. How is Masters FA different than PGDFA?

Ans: There are few differences:

- Masters is a degree while PGDFA is a diploma

- Masters covers Level 3 curriculum also

- Masters includes employability enhancing modules like Strategy, Financial Modelling and technical analysis which are missing in PGDFA

- There is no internship in PGDFA which is present in Masters for 2 months.

- PGDFA is a one year program as against Masters FA which is of two years.

Q4. What are the employment opportunities after Masters (FA)?

Ans: Refer career opportunity section. https://www.icofp.org/mba-in-financial-analysis/career-opportunities.php

Q5. Financial Analysis is the most happening job for fresher. Is this true?

Ans: 20 years ago, India was a favorite destination for accounting related jobs. The number of jobs is still the same; the nature has changed in the last 5 years. There are many jobs but for data analyst. Financial Analyst is one of those and certainly one of the most happening for freshers.

Q6. What are the chances of getting a job abroad after Masters (FA)?

Ans: Masters FA gives knowledge enough to clear all 3 levels for CFA. Once CFA® is done, the international acceptability of the candidate increases manifold into global financial markets like New York, London, Singapore, Hong Kong, etc.

Q7. Will Financial Modelling be a part of the curriculum?

Ans: Yes. Financial Modelling is taught in detail in the 3rd Semester of Masters FA.

Q8. How in-depth will be the technical analysis?

Ans: CFA as a course is based on the fundamental analysis. But to make one a complete finance professionals, Masters FA includes one complete module of technical analysis in 3rd Semester of Masters FA.

Q9. Will a student get an internship opportunity from the placement cell of college?

Ans: Yes. ICOFP has a placement cell which provides assistance in internships.

Q10. Does a student get any exemption from CFA institute’s CFA exams because of its candidature in Masters (FA)?

Ans: Masters FA Program affiliated with and degree awarded by UGC Approved University capsulating the curriculum of CFA® Program USA. A student will have to clear CFA® exams (all 3 levels) by registering oneself in the CFA® Program.