PG Diploma In Financial Planning

A comprehensive 1 year diploma program/Executive MBA in Financial Planning in association with Jawaharlal Nehru Technical Education – Council of Skill development (JNTE-CSD)

Financial Planners are the latest breed of professionals worldwide who through their own entrepreneurial practices or while working with banks/ investment advisory companies prepare financial plans for their clients and help them achieve their financial goals.

Financial Planning and Wealth Management are buzz words in the finance industry. It is one of the most prestigious and well-paid professions in the financial services sector. Financial Planning is the process of assisting an individual to meet his financial goals through the proper management of his wealth. Professionals working in the field of finance can enhance their career prospects with PG Diploma in Finance.

Financial Planners are the latest breed of professionals worldwide who through their own entrepreneurial practices or while working with banks/ investment advisory companies prepare financial plans for their clients and help them achieve their financial goals. Our 1 Year MBA program is aimed at advancing career options for professionals.

PG Diploma Program Overview

Post Graduate Diploma in Financial Planning course provided by the International College of Financial Planning in Association with Jawahar Lal Technical Education-CSD, is designed by industry stalwarts in such a way that besides preparing students for the Financial Services industry. The Post Graduate Diploma in Finance also prepares the students for internationally recognized certifications such as an Associate Financial Planner (AFP) & Certified Financial Planner(CFP)which are authorized by FPSB, India and various other industry recognized certifications like AMFI Mutual Fund Module, Debt & Securities Market Module etc. The candidates will be awarded the Post Graduate Diploma in Financial Planning after successful completion of the course.

Executive MBA Program Objectives

- To prepare students for internationally recognized CFPCM certification recognised in 26 countries of the world.

- To nurture and groom the aspirants in order to match the requirement of the financial industry.

- To improve students’ technical and interpersonal skills through the use of case studies.

- To engender the required analytical knowledge and skills in order to develop proficient financial planners.

Unique Aspects

- A Unique Industry-integrated course.

- Rich content based on the analysis of job requirements.

- Placements Assistance.

- Multiple certifications obtained during the course.

Career Scope

The PGDFP course will train the candidates with the ability to manage the funds and portfolios of various customers under various capacities while working with top industry professionals in the insurance, banking, mutual funds, stock broking and financial planning and investment groups in India and abroad.

Note

PGDFP course is available in Delhi & Mumbai Campus.

Curriculum

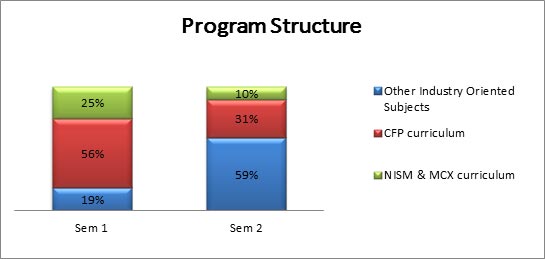

Program Structure

PG in Financial Planning program comprise a highly specialized curriculum centered around financial planning which integrates the curriculum of some of the most acclaimed professional certifications globally. The program incorporates the curriculum of internationally accepted Certified Financial Planner CM Certification and industry required NISM & MCX certifications.

Pedagogy

Elbert Einstein said “Education is not the learning of facts but the training of minds to think”. True education is what remains after you forget everything else. Right training does not give you the solution to the problems but the ability to find the problem and create a solution. With strong belief in this philosophy, ICoFP has designed a unique pedagogical system that encompasses highly specialized and effective teaching aides.

- Experienced and highly qualified teaching faculties mostly with industry background

- Project and case study based teaching in key subjects

- Special training to qualify most important external certifications such as CFP, NISM and MCX etc.

- Heightened focus on activity based learning through various student clubs and special projects

- Relevant industry visits and guest industry lectures

Program Content

1. Introduction to Financial Planning: This module covers the six-steps of financial planning process, time value of money applications, personal financial statements, cash flow and debt management, overview of risk management, investment planning and retirement planning, code of ethics, and business aspects of financial planning.

2. Risk Analysis & Insurance Planning: This module covers the knowledge requirements relating to insurance needs and risk assessment of clients. It introduces students to various concepts and regulatory environment of insurance in India.

3. Investment Planning: This module covers the critical knowledge of different asset classes and interplay amongst them, the investment products constituting such classes and their investment risk profile to enable the management of a client’s finances towards achieving various financial goals.

4. Retirement Planning and Employee Benefit: This module covers the knowledge of basic strategies towards achievement of objectives of a client of his/her post-retirement financial and other needs and ways to systematically build the required corpus. Mutual Funds and Equity Derivatives: These modules will prepare students for the external NISM examinations.

5. Mutual Funds: This module provides the individuals with the requisite skills and enables them to compare and analyse mutual fund schemes and advice their client the best suited investment option as per their requirement.

6. Equity Derivatives: This module provides insights into different types of derivatives products available in equity derivatives markets, regulations and risks associated with the products, the exchange mechanisms of clearing and settlement, and the regulatory framework.

7. Tax & Estate Planning: This module covers the knowledge requirements of Indian Tax System, specifically related to Direct Taxes and personal taxation. The Estate planning is emphasized not as a late stage requirement but a necessary succession arrangement always in place for all assets – fixed, physical and financial.

8. Advanced Financial Planning: This module will enrich students with required knowledge and skills to assess the entire financial situation of a client, financial goals of the client to meet in the near and long term, the parameters related to the economy, the financial market to develop a comprehensive financial plan.

9. Financial Plan Construction: You are a freelance financial planner working on fee based compensation only. You have just started this practice and therefore offering free financial plans for first five clients. You have to approach a client who could be your relative, friend, etc. above 35 years, working and earning and have to develop a financial plan. You have to follow the financial planning process to create this financial plan.

10. Wealth Management Project: The objective of the project work is to develop the problem solving ability in a time bound manner. They should be able to demonstrate the ability to set objectives, sound understanding of concepts, application of theory on real life problems, flexible approach, systematic procedures for achievement of output in timely manner. Students have to work on the real life projects and apply the suitable methodology and analytical tools for problem solving and draw the inferences from the output of project work. They should be able to defend their original work while presenting it to onsite supervisor/examiner.

Admissions

Course Duration

The duration of the course is 10+2 months in full time mode, which includes an internship of 2 months in a financial sector company.

Eligibility & Admission Process

Admission Procedure: Our PG programs are targeted towards individuals with high potential for success in the financial services sector. Selection at ICoFP is therefore very rigorous & competitive.

- The candidate must possess a Bachelor’s Degree.

- The Bachelor’s Degree (or equivalent qualification with minimum of 45%) obtained by the candidate must entail a minimum of 3 years of education after completing Higher Secondary School (10 + 2 or equivalent).

- Candidate applying for their final year exams can also apply subject to furnishing a proof of graduation by 15th September.

1. Application: ICoFP Prospectus and Application Form and can be acquired by one-time payment of Rs. 1000/- for one program.

- By cash payment at our counseling offices.

- By post (enclosing demand draft drawn in favor of “International College of Financial Planning ltd.” payable at New Delhi).

- On-line application through click here (need to make the payment by credit/debit card).

2. Admission Test: Candidates are required to appear for “AMCAT (The AMCAT is a computer adaptive test which measures critical areas like communication skills, logical reasoning, quantitative skills, thus helping us to identify the suitability of a candidate.)” conducted by International College of Financial Planning. The candidate has to undergo a rigorous selection procedure comprising of Written Test, Group Discussion & Personal Interview. All candidates who have appeared for CAT/ MAT can also apply to ICoFP with their score. Short listed candidates will have to appear only for GD & PI. Group Discussion and personal interview are also integral components of the admissions process. The overall objective is to identify and assess the candidate’s communication ability, in addition to the overall knowledge of the student. IIMs have no role either in the selection process or in the conduct of the program.

3. Admission Offer: Final selection will be based on a careful evaluation of the applicant’s academic record from class X, through graduation and/or post graduate qualification, work experience (if any), extra curricular activities, Group Discussion and personal Interview. Successful candidates will be informed of their final selection by courier/ phone call. The selected candidates must pay their first fee installment within two weeks of receiving the admission offer, failing which the offer will be withdrawn.

Career Opportunities

It takes great amount of work and boldness to make a fortune but it takes 10 times those qualities to preserve it.— Ralph Waldo Emerson.

Post Graduate Diploma in Financial Planning (PGDFP) from ICoFP not only gives you a diploma but an exciting career in one of the most booming Financial sector of the economy. Students completing PGDFP have plethora of career avenues in Banks, Asset Management Companies, Non-Banking Financial companies, Insurance, Stock Broking, etc. Some of the job profiles likely to be offered to PGDFP students are:

1. Financial Planners: Financial Planners are like Financial Doctors. PGDFP fully incorporates the curriculum of CFP. CFP being the highest qualification and only recognized Financial Planning qualification. Financial Planners provide guidance to clients to help them achieve their financial goals. Financial Planners are hired by pure financial Planning companies such as Fincart, Finedge, etc. apart from banks, wealth management companies, etc.

2. Investment Advisor: CFP has been recognized as one the qualification to register as Investment Adviser under SEBI Investment Advisor Regulations. All finance companies offering wealth management services and investment advisory companies including brokers need to register as Investment Advisors with SEBI. Hence, students completing PGDFP have huge opportunity with various SEBI Registered Investment Advisors.

3. Wealth Management: A wealth manager’s job essentially entails understanding the client’s risk appetite and advising him accordingly on the various investment options available to increase wealth. The advice they offer is wide-ranging and varied. It can cover taxes to asset protection; investments to property advice. So the responsibility of making the client’s money make more money ultimately lies with the Wealth manager. Wealth managers are hired by Banks, Wealth Management companies, Distribution Companies etc. These jobs carry targets and involve client acquisition, servicing and retention.

4. Brokers/Dealers: A stockbroker serves the financial interests of his clients. He executes trades and sells securities and commodities to individual clients, advises clients on what investments suit their financial situations and can manage clients’ investment portfolio. A broker must stay on top of the market at all times by analyzing, monitoring and researching the performance of stocks, trade markets and acquisitions.

5. Asset Management Companies: Asset management companies manage the investor’s money in order to achieve a financial objective within specific guidelines of the various investment schemes. There are current 43 asset management companies in India which require not only fund managers, research analysts but also need financial advisers and relationship managers to educate clients about the new products, services and offerings of the asset management companies.

6. Client Services Manager: Client Service Managers serve as a relationship management point of contact for clients of Financial Advisors. They are responsible for daily operations, client service, record keeping and sales support. They are the primary point of contact for all service related needs of the clients. Client Service Managers are hired by banks, wealth management companies, insurance companies, non-banking financial companies.

7. Others: Financial Planning professionals have a great scope in the industry. Apart from the above mentioned profiles, there exist lot of other options in the industry such as Commodities markets, Currency Markets, Insurance and Mutual Funds.

FAQs

Q1. What is the duration of PGDFP Program?

Ans: PGDFP is a 1 year full time face-to face classroom teaching program.

Q2. Is PGDFP a degree or diploma program?

Ans: PGDFP is one year Diploma program from University of Mysore which is recognized by University Grants Commission (UGC).

Q3. What is the eligibility criterion for getting admission to PGDFP programs?“

Ans:

- The candidate must possess a Bachelor’s Degree.

- The Bachelor’s Degree (or equivalent qualification) with minimum of 45% obtained by the candidate must entail a minimum of 3 years of education after completing Higher Secondary School (10 + 2 or equivalent).

- Candidate applying for their final year exams can also apply subject to furnishing a proof of graduation by 15th September.

Q4. What are the advantages of joining PGDFP program?

Ans:

- PGDFP integrates the curriculum of globally recognized CERTIFIED FINANCIAL PLANNER CM (CFPCM) certification along with industry required professional certifications which significantly enhances career prospects in India as well as abroad.

- Candidates pursuing PGDFP can appear for CFP Certifications which is highest Financial Planning qualification worldwide. CFP and AFP (Retirement Planning) Certification awarded by FPSB India has been prescribed as one of the qualifications to become Investment Advisor (to be registered with SEBI) and Retirement Advisors (to be registered with PFRDA).

- Candidates will also be able to appear for external NISM Certification such as NISM-Mutual funds; NISM: Securities Market; NISM: Equity Derivatives, etc. making the candidates preferred choice of recruiters.

- You get Diploma from University of Mysore which is recognized by University Grants Commission (UGC).

Q5. Is PGDFP program recognized as the 16th year of education to apply in foreign universities?

Ans: Yes, PGDFP program is recognized as the 16th year of education internationally.

Q6. Do you provide placement assistance after completion of PGDFP?

Ans: Yes, ICoFP has a very strong industry network and a strong alumni base of over 11,000 students. PGDFP students are preferred by non-banking financial companies, asset management companies, financial planners, brokers, wealth management companies, investment advisors, insurance companies, etc.

Q7. What portion of the Banking & Finance curriculum is covered in the PGDBF ?

Ans: As a fresher, one can get jobs in varied jobs profiles such as Relationship Manager, Technical analyst, Dealer, Financial Planner, Client Servicing Manager, Research Associate, etc.

Refund & Cancellation Policy

Once the college accepts the admission of a student, no refund of fee will be allowed under any circumstances.