Chartered Financial Analyst®

The Chartered Financial Analyst® is a globally recognized investment profession credential which is offered internationally by the US based CFA Institute. The CFA® designation is one of the most respected and recognized finance qualification accepted worldwide. The CFA® Program is a globally recognized standard for measuring the proficiency and integrity of finance and investment professionals.

The Chartered Financial Analyst® (CFA®) credential is held by over 150,000 professionals around the world. The charter demonstrates a strong understanding of advanced investment analysis and real-world portfolio management skills.

The CFA charter equips you not only to enter the profession but also to excel at all stages of your career

Our rigorous curriculum will equip you for complex investment decisions.

Connect with an exclusive group of outstanding investment professionals.

Gain confidence and clarity in navigating ethical issues.

Earn waivers from regulatory agencies, graduate programs, and more.

Gain access to career guides, thought leadership, and continuing education.

CFA Institute does not endorse, promote, or warrant the accuracy or quality of the products or services offered by International College of Financial Planning. Chartered Financial Analyst® and CFA® are trademarks owned by CFA Institute.

Eligibility

CFA Level I Exam : Even a final year graduate can appear for CFA Level I exam (Passport Mandatory)

CFA Level II Exam : Applicant should have completed graduation and cleared CFA Level I exam

CFA Level III Exam : Applicant should have cleared CFA Level II exam

CFA Charter Holder Membership requirements include, but not limited to, 48 months of acceptable professional work experience and passing the Level I, Level II and Level III exams.

About the Exam:

Administered by CFA Institute, US

Minimum Time to pass all three exams: 2 years Average Time: 4 years

CFA Exam Centers

The Dec exams are being offered at test centers located in:

1. MUMBAI 2. KOLKATA 3. BANGALORE 4. NEW DELHI 5. LUCKNOW

The June exams are being offered at test centers located in:

1. MUMBAI 2. KOLKATA 3. BANGALORE 4. CHENNAI 5. NEW DELHI 6. AHMEDABAD 7. PUNE 8. BHOPAL 9. LUCKNOW 10. HYDERABAD

Why ICoFP, CFA®

Promoted by Bajaj Capital Group, one of the largest investment service firms in India with a heritage of over five decades and having served a million plus Indian Investors across the world

One of the select institutes in India offering super specialized education in the field of financial analysis, financial planning, technical analysis and more

Authorised Education Partner for international certifications like CFP , CFA , and more

Trained over 12,000 professionals and students in past 18 years

Over 8 years experience of delivering CFA curriculum as part of MBA (Financial Analysis)

Online Technology Platform and relevant content (Including video tutorials)

Conceptual learning complemented with practical application and a rigorous testing framework

Program Benefits

- Gold Standard : The CFA® charter equips you not only to enter the profession, but also to excel at all stages of your career.

- Strong Ethical Foundations : Gain confidence and clarity in navigating ethical issues.

- Global Passport : Earn waivers from regulatory agencies, graduate programs, and more.

- Unmatched Expertise : Our rigorous curriculum will equip you for complex investment decisions.

- Prestigious Network : Connect with an exclusive group of outstanding investment professionals.

- Career Resources : Gain access to career guides, thought leadership, and continuing education.

Curriculum Overview

The CFA® Program curriculum is offered in English only, like the exams. The curriculum is organized into three levels and each level is organized into 17–18 study sessions. Each study session includes assigned readings, learning outcome statements (LOS), and problem sets.

All exam questions are based on the content in the corresponding curriculum for that level. Each exam question is based explicitly on one or more LOS.

The CFA® Program curriculum increases in complexity as you move through the three levels.

Ethical and Professional Standards

The increase in complexity can be demonstrated with the ethical and professional standards curriculum content. This content is similar for each exam level; however, candidates are asked different types of questions:

- Level I tests your knowledge of the ethical and professional standards.

- Level II tests how you apply those standards to situations analysts face.

- Level III tests how you apply the standards in a portfolio management and compliance context.

|

LEARNING FOCUS |

TOPIC FOCUS |

|

|---|---|---|

| Level I | Knowledge and Comprehension | Investment Tools |

| Level II | Application and Analysis | Asset Valuation |

| Level III | Synthesis and Evaluation | Portfolio Management |

CFA Topic Exam Area Weights

| Ethics | Quant | Eco | FRA Accounts | Corp Fin | Equity | Fixed Income | Derivatives | Alternative Invt | Portfolio Mgmt | Total | |

| Level I | 15 | 10 | 10 | 15 | 10 | 11 | 11 | 6 | 6 | 6 | 100 |

| Level II | 10–15 | 5–10 | 5–10 | 10–15 | 5–10 | 10–15 | 10–15 | 5–10 | 5–10 | 5–15 | 100 |

| Level III | 10–15 | 0 | 5–10 | 0 | 0 | 10–15 | 15–20 | 5–10 | 5–10 | 35–40 | 100 |

* These weights are intended to guide the curriculum and exam development processes. Actual exam weights may vary slightly from year to year. Please note that some topics are combined for testing purposes.

For more information, visit https://www.cfainstitute.org/

Program Edge

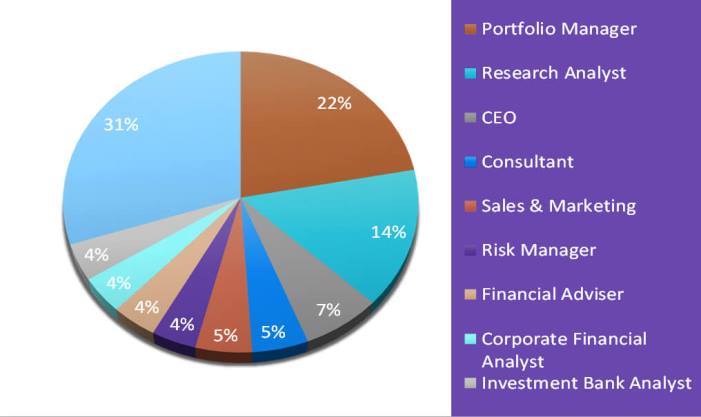

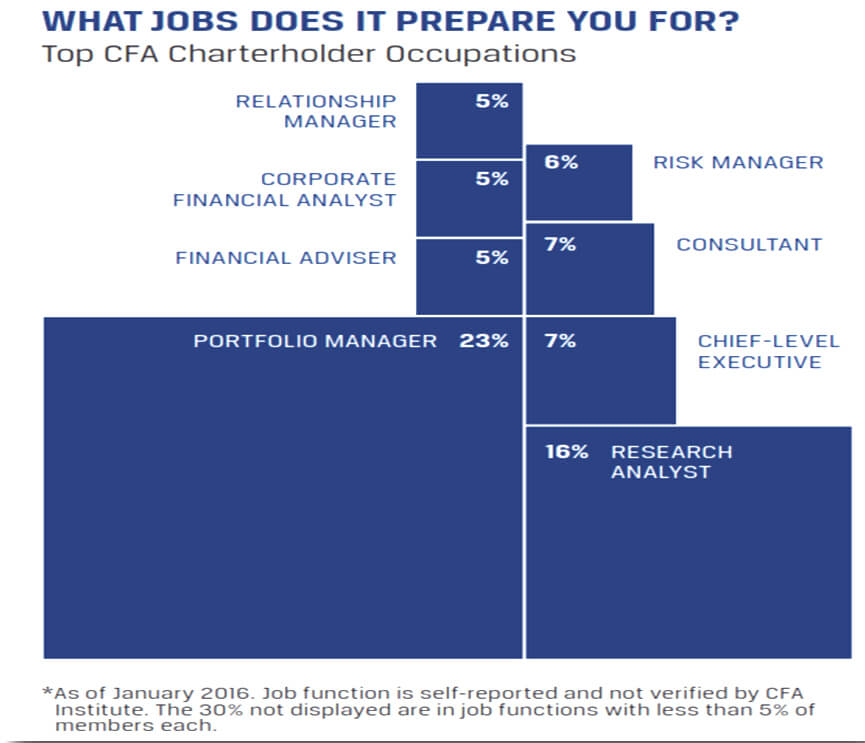

Why earning a CFA® charter is a smart investment for the future?

- The CFA® designation is globally recognized by employers, investment professionals, and investors.

- It provides a passport for working within numerous investment specialties and finance companies across the globe.

- In today’s fast-evolving global financial industry, earning the CFA® charter equips candidates with the skills required for real-world investment analysis, decision making and portfolio management skills.

- CFA® charter and an MBA complement each other as CFA® Program focuses specifically on investment knowledge and most MBA programs cover a broad range of topics.

- As the global marketplace becomes increasingly competitive, employers recognize the CFA® charter as a reliable way to differentiate the most qualified job applicants and the most committed employees.

- CFA® designation is often listed as a requirement in most of the job advertisements by the finance and investment companies.

Disclaimer: CFA Institute, CFA®, and Chartered Financial Analyst ® are trademarks owned by CFA Institute.

Admission procedure

Option 1 : Online Payment Facility

Make Payment via Debit/Credit Card/ Net banking through our online Payment Gateway after filling your application form Please proceed using the following URL : https://icofponline.com/easypayonline.aspx

Option 2 : Bank Transfer

You can make payment through bank account details :

Name of Beneficiary – International college of financial planning Bank Name – Axis Bank Account Number – 279010200011732 Account Type – Saving Branch – Darya Ganj, Delhi IFSC/RTGS Disc Code – UTIB0000279 ( For banks within India )

CFA® FAQs

Will CFA Institute notify my employer that I have been awarded the CFA charter? CFA Institute does not notify your employer directly, but along with your confirmation letter you will receive a letter for your employer.

When will I receive my CFA charter?

If your society is hosting a charter recognition event between 1 September and 31 January, you will be invited to receive your charter at the event. Otherwise, your charter will be mailed to your primary address within 12 weeks of the date that you complete all requirements.

Where is the CFA designation from CFA Institute recognized?

The CFA designation is recognized everywhere. In addition, several countries have recognized the quality of our CFA Program and designation by allowing passage of Level I of the exam or achievement of the CFA charter to meet certain licensing or qualification requirements

Can I use my CFA designation in India?

Yes, CFA charterholders from CFA Institute have always been, and continue to be, free to use the “CFA” and “Chartered Financial Analyst” marks throughout India.

What is the future of CFA Institute in India?

CFA Institute now has six CFA test centers in India (Bangalore, Chennai, Kolkata, Mumbai, New Delhi, and Pune). We will continue to work with the Securities and Exchange Board of India and the National Institute of Securities Markets and plan to strengthen resources to universities and faculty in India. Please continue to watch www.cfainstitute.org/india for updates about our activities in India.

In quantitative methods we refer to the z-table, t-table, and F-table. Will these tables be provided during the exam? No. CFA Institute does not provide distribution tables with the exam. If a question requires information from a specific distribution table, that information will be provided with the question, but the tables themselves will not be provided. Similarly, time value of money tables (present value, future value, etc.) are neither needed nor provided. The two approved calculators are capable of performing any required present value and future value calculation.

Will I be allowed to use scratch paper during the exam?

No. Also, exam admission tickets must not be used as scratch paper. However, you are permitted to do scratch work in the exam book on question pages or pages marked “This Page Intentionally Left Blank.”

Do the pass/fail numbers published by CFA Institute include all the registered candidates or just the ones who took the exam?

The published pass rates include only those candidates who actually took the exams. The numbers do not include no-show candidates or those who withdrew.

Why doesn’t CFA Institute let candidates know what score is required to pass an exam or what score candidates achieved on the exam?

The minimum passing score (MPS) for each level of the exam is determined by the CFA Institute Board of Governors each year after the administration of the exams

Do I have to pass each of the individual topic areas in order to pass an exam level?

No. As long as you achieve a total score above the minimum passing score (MPS) set by the CFA Institute Board of Governors, you would pass the exam regardless of your performance on any individual topic. However, we advise against any “test wise” strategy that recommends ignoring a topic in your study.

I answered a question part on a page other than the designated answer page for the question part. Will my answer be graded?

No. Only answers written on the designated answer page for each question part are graded.

I did not fill in the bubbles all the way on my answer sheet. Will this affect grading?

Possibly. We ask candidates to make heavy black marks that fill the ovals completely. If this is not done it may affect how the scanning machine reads and records your marked responses on the scan sheet. We will grade your answer sheet as you have completed it.

Source : CFA Website ( For more information please refer to https://www.cfainstitute.org )

Refund & Cancellation Policy

Once the college accepts the admission of a student, no refund of fee will be allowed under any circumstances.