Masters FP FAQs

Q1. What is the objective of Masters FP program offered by ICOFP?

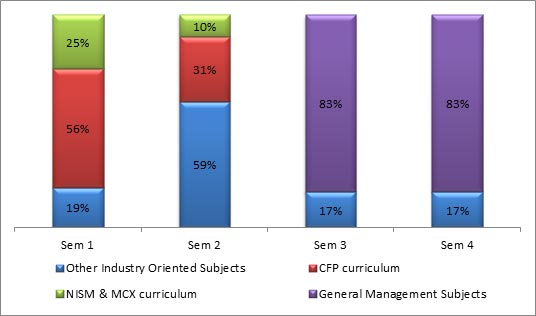

Ans: Masters FP is a program designed by industry stalwarts in such a way that besides preparing students for Financial Services industry, it also prepares the students for internationally recognized certifications such as Associate Financial Planner (AFP) & CERTIFIED FINANCIAL PLANNERCM which are authorized by FPSB, India and various other industry recognized certifications like NISM-Mutual Funds Module, NISM-Equity Derivatives Module, NISM securities markets.

If you want to make a career in finance industry, a lot of schools have Masters programs but a specialized Masters FP is something that can set you apart in the industry.

Q2. What is the duration of Masters FP Program?

Ans: Masters FP Program is a 2 year program. Since, it is an industry integrated program, candidates are placed in the industry after completion of 1 year of the program. The 1st year is full-time through face-to face classroom training and 2nd year is through online mode. We also provide with doubt sessions in year 2.

Q3. IS Masters FP a degree or a diploma program?

Ans: You get a degree for the two years full time Masters Program affiliated with and degree awarded by UGC Approved University.

Q4. What is the application and selection process to ICoFP post graduate programs?

Ans: 1. Application: ICoFP Prospectus and Application Form can be acquired by one-time payment of Rs. 1000/- for one program. To apply click here, http://www.icofp.org/payment.php.

2. Entrance Test and Selection Process: The candidate has to undergo a rigorous selection procedure comprising of Written Test and two rounds of Personal Interview.

- Candidate has to appear for ‘AMCAT’ entrance test. “AMCAT” is a computer adaptive test which measures the prospective candidates on critical areas like communication skills, logical reasoning, and quantitative skills. All candidates who have appeared for CAT/ MAT can also apply to ICoFP with their score.

- Short listed candidates will have to appear for two Personal Interviews with a panel. The overall objective is to identify and assess the candidate’s communication ability, in addition to the overall knowledge of the student.

- Final selection will be based on a careful evaluation of the applicant’s academic record from class X, through graduation and/or post graduate qualification, work experience (if any), extra-curricular activities, performance in entrance test and personal Interview. Successful candidates will be informed of their final selection by courier/ phone call. The selected candidates must pay their first fee installment within two weeks of receiving the admission offer, failing which the offer will be withdrawn.

Q5. What is the eligibility admission for admission to ICoFP post graduate programs?

Ans:

- The candidate must possess a Bachelor’s Degree.

- The Bachelor’s Degree (or equivalent qualification) with minimum of 45% obtained by the candidate must entail a minimum of 3 years of education after completing Higher Secondary School (10 + 2 or equivalent).

- Candidate applying for their final year exams can also apply subject to furnishing a proof of graduation by 15th September.

Q6. What is the difference between generic Masters offered by other colleges and Masters in FP offered by CFP?

Ans: ICoFP offers super specialized programs in Finance. ICoFP’s highly specialized Masters FP programs prepare a student to handle a job in the finance industry and are designed to cover everything the student needs to know to do that job. The skills obtained in traditional business schools are better suited for employees in more general disciplines, such as marketing or general management whereas ICoFP’s Masters FP prepares a student to handle a job in the finance industry and is designed to cover everything the student needs to know to do that job. Moreover, PGDBM offered by various institutions is not AICTCE or UGC accredited whereas Masters FP degree affiliated to UGC Approved University.

Q7. Can I pay the fees in installments?

Ans: Yes, you have the option to pay the fees in installments.

Q8. Is hostel accommodation available for the students?

Ans: We have a tie up with many hostels & PGs which are near to ICoFP college campus. The accommodation is available for students as per requirement.

Q9. Can I get a sponsorship from the company where I am working?

Ans: Yes. Applicants are encouraged to get themselves sponsored by their employers.

Q10. Do you have any quotas for NRI’S/SC/ST/BC?

Ans: No. We do not. However, ICoFP encourages applications from candidates with diverse backgrounds.

Q11. Which are the top five recruiters of students who have done Masters FP from ICOFP?

Ans: Students who have completed Masters FP have taken up a wide range of assignments with banks, distribution houses, AMC, insurance Companies, equity broking and Financial Planning firms and many have successfully set up their own investment advisory business. The top 5 companies to be included are-Ameriprise, Religare securities, ICICI prudential asset Management Company, Edleweiss broking and Humfauji.

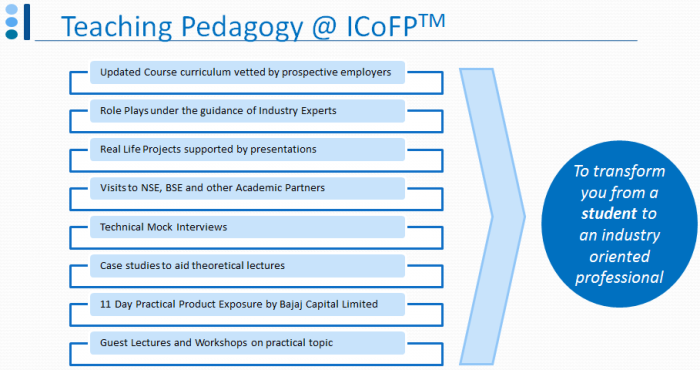

Q12. What is the teaching pedagogy at ICoFP?

Ans: The teaching methodology used targets converting the rigorous academic experience during the program into rich practical knowledge by the end of program. Using techniques such as case studies, live projects, assignments, workshops, expert mentoring, real industry exposure in specific career segment are employed.

Q13. Does ICoFP have any scholarship opportunity for Masters Program aspirants?

Ans: Yes, ICoFP offers scholarships to deserving candidates. We also have scholarship scheme for girl child. Refer to the following link for details:

http://www.icofp.org/scholarship-support.php

Q14. What if, I have not received final degree or certificate of Graduation?

Ans: Candidates who are in their final year of graduation or awaiting their certificates need to submit a letter from their college/university stating the fact that their final degree is awaited..