CFA Certification Course

The CFA curriculum covers academic theory, current industry practice, and ethical and professional standards to provide a strong foundation of advanced investment analysis and real-world portfolio management skills. Clearing all three levels along with relevant work experience ensures professional excellence for those who have earned the charter. The topics covered by the CFA curriculum are:

- Ethical and Professional Standards

- Quantitative Methods

- Economics

- Financial Reporting and Analysis

- Corporate Finance

- Portfolio Management

- Equity

- Fixed Income

- Derivatives

- Alternative Investments

Overview of CFA Courses

The CFA program consists of a series of three exams: Level1, 2 and 3 conducted every year, each culminating in a six-hour exam. All three levels require dedicated six months of preparation. The program progresses in complexity as you move through the three levels. Clearing all three levels lead to award of prestigious CFA designation. CFA courses prepare you for the challenges you’d face at all

levels of this program.

At Level I, you will be asked basic knowledge and comprehension questions focusing on asset valuation. Some questions will require that you perform analysis. Level II further emphasizes analysis along with application, while Level III focuses on synthesizing basic knowledge with evaluation tools and analytical methods for effective portfolio management. When you join CFA courses you get deep insights into the preparation required for all the three levels.

LEVEL I: TOOLS

- Tools and concepts that apply to investment valuation and portfolio management

- Basic concepts regarding asset classes, securities, and markets

- CFA Institute Code of Ethics and Standards of Professional Conduct

LEVEL II: ASSET VALUATION

- Application of tools and concepts of investment valuation

- Industry and company analysis

- Analysis of investment vehicles and instruments

- CFA Institute Code of Ethics and Standards of Professional Conduct

LEVEL III: PORTFOLIO MANAGEMENT

- Management of institutional and individual portfolios

- Management of specific asset class portfolios

- CFA Institute Code of Ethics and Standards of Professional Conduct

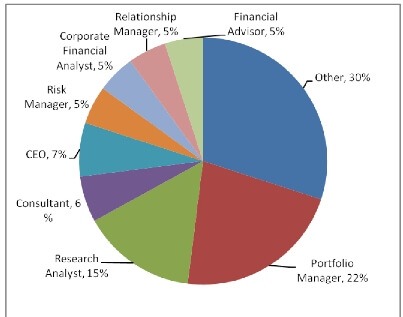

Top Occupations of CFAs Globally

CFAs globally are working in number of areas of finance. The professional breakdown for most CFAs is illustrated in the following chart:

The CFAs are hired by all global companies in the finance domain. Top ten companies that usually favor CFAs for investment profile include:

- JP Morgan Chase

- PwC

- HSBC

- Bank of America Merrill Lynch

- UBS

- Ernst & Young

- RBC

- Citigroup

- Morgan Stanley

- Wells Fargo

CFA Program Candidates

In FY14, the CFA Institute received over 210,000 exam registrations across three levels. Top occupations of CFA Candidates (who enroll for CFA examinations) are:

chart2 - CFA Certification Course

Values and benefits of being a Charterholder

- CFA charter shows mastery of the skills much needed in investment analysis and decision making in today’s fast evolving global financial industry.

- CFA program is a cost-effective way to gain skills in today’s global investment profession and make transition to a career change in investment profession.

- CFA program helps to make a wide variety of career choices in investment profession owing to its complete knowledge base in finance.

- CFA helps you make sound investment decisions in ever changing world of finance.

- The CFA Program curriculum is based on an extensive and ongoing global practice-analysis process that relies on input, discussions, surveys, and review from thousands of active practitioners and CFA charterholders.

- The CFA Program is designed for self-study, which helps you to gain charter while working.

- CFA institute also conducts eductaional and nertworking events for its members around the world.

- CFA institute conducts research and provide webcasts, and article abstracts on timely topics prepared by thoughtleaders and academic experts from around the world.