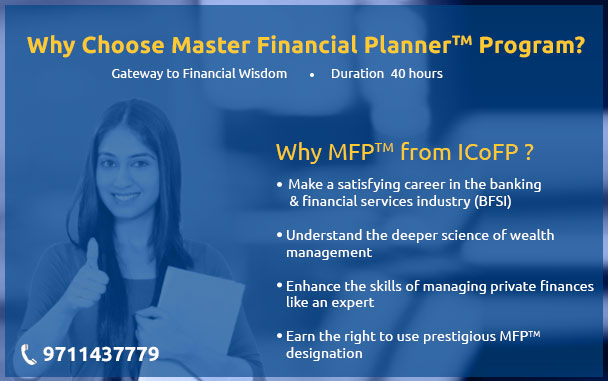

Master Financial Planner (MFPTM)

Financial services are one of the fastest growing sectors of the economy. : According to a report by National Skill Development Corporation (NSDC) on Human Resource and Skill Requirements in the Banking and Financial Services Industry (BFSI), it is expected that about 8.4 million persons would be employed in the BFSI industry, considering the growth expected in the BFSI industry. As per this report, the incremental human resource requirement between 2008 and 2022 is expected to be about 4.2 million. The majority of this requirement will be in wealth management, financial advisory, Insurance and Financial Planning.