With a 6th largest economy in the world by nominal GDP, India has faced slowdown in past 2 years because of many International and national factors.

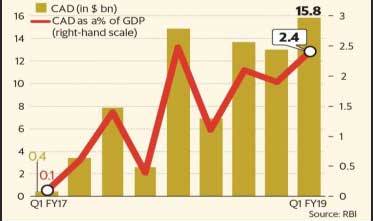

Some of which are Trade war between USA and China, slowdown of global economy growth due to lack of demand, rising crude oil prices, falling currencies and continuous FII outflow (Net Rs – 99,496 crore in 2018) which lead the Indian Rupees to all time low and widening of India’s current account deficit to a four-year high of 2.9% of GDP. Moreover, the Indian markets are facing liquidity issues because of IL&FS defaults and the most recent growing rift between India’s central bank and the government, which result in resignation of Urjit Patel (Former RBI Governor). Apart from this, two rate hikes have been announced this year and the current monetary policy stance is one of calibrated tightening from RBI to maintain the inflation target of 4 (+/-2) percent.

However, currently the Inflation is at its lowest since June 2017 as food prices continued to decline and the current lower crude costs brought down fuel inflation.

The RBI now expects inflation to remain between 2.7 to 3.2 percent for the second half of the year which is still within the flexible range of 4 (+/-2) percent set for the Monetary Policy Committee. Also, Growth in the index of industrial production (IIP) which slowed down earlier this year have recovered in October getting a boost from demand ahead of the festival season. It rose 8.1 percent over last year in October, compared with a revised 4.5 percent growth in July, data released by the Ministry of Statistics and Programme Implementation showed. Primary goods output rose 6 percent, capital goods output increased 16.8 percent, Output of intermediate goods grew 1.8 percent, Infrastructure goods production rose 8.7 percent and Consumer durables output rose 17.6.

The RBI now expects inflation to remain between 2.7 to 3.2 percent for the second half of the year which is still within the flexible range of 4 (+/-2) percent set for the Monetary Policy Committee. Also, Growth in the index of industrial production (IIP) which slowed down earlier this year have recovered in October getting a boost from demand ahead of the festival season. It rose 8.1 percent over last year in October, compared with a revised 4.5 percent growth in July, data released by the Ministry of Statistics and Programme Implementation showed. Primary goods output rose 6 percent, capital goods output increased 16.8 percent, Output of intermediate goods grew 1.8 percent, Infrastructure goods production rose 8.7 percent and Consumer durables output rose 17.6.

Indian Economy- Road Ahead

India is being viewed as a potential opportunity by investors and has emerged as one of the most attractive market for investments, with the economy having the capacity to grow tremendously. Buoyed by strong GDP growth, FII investments are also expected to improve going forward.

But on the short term the overall pace of economy is expected to be slow owing to factors such as:

- Global growth momentum is moderating.

- Tight financial conditions due to banking liquidity crisis are likely to have an adverse impact on consumption discretionary demand, the commercial real estate and SME segments.

- Appointing the new RBI governor and the resigning of the former one before the term ending doesn’t show a good sign. Directly or indirectly it hampers the Central Bank credibility.

- 2019 Election result is also going to shape the structure of India’s future economy.

- Even though the rupee is getting stable, yet the foreign investment will take time to get back on track.

- Government is still lacking in collecting the expected amount of GST.

Oil and Gas Sector

The oil and gas sector is one of the eight core industries in India and plays a major role in influencing decision making for all the other important sections of the economy.

India is the third largest consumer of oil and the fourth-largest Liquefied Natural Gas (LNG) importer in the world with the imports rose sharply to US$ 87.37 billion in 2017-18 from US$ 70.72 billion in 2016-17 and this demand is anticipated to grow faster than any other major economies, on the back of continuous robust economic growth. Therefore Government of India has adopted several policies to fulfil the increasing demand. The government has allowed 100% FDI in many segments of the sector, including natural gas, petroleum products, and refineries, among others. Today, it attracts both domestic and foreign investment, as attested by the presence of Reliance Industries Ltd (RIL) and Cairn India.

Crude oil consumption is expected to grow at a CAGR of 3.60 to 500 million tonnes by 2040 from 221.76 million tonnes in 2017. On the same side Natural Gas consumption is forecasted to increase at a CAGR of 4.31 per cent to 143.08 million tonnes by 2040 from 54.20 million tonnes in 2017.

Demand and Supply in Oil and Gas Sector

India imported $80.3 billion valued oil in FY17 as comparison to $70 billion in FY16. In FY18, up to November, crude oil production and imports stood at 0.48 and 2.89 mbpd respectively.

With the rapid growth of Indian economy, expansion in industries and rising urbanisation, the demand for oil and gas is going to increase rapidly. Also with rising income levels, demands for automobiles are likely to increase which will again increase the demand for oil and gas. According to OPEC, the demand for oil is going to be highest from India in coming future.

Domestic production account for more than three-quarter of the country’s total gas consumption

Industry Future Outlook

- In August 2018, IOC announced Rs 22,000 crore capital expenditure plan for 2018-19.

- BPCL plans to invest Rs 1.08 trillion (US$ 14.83 billion) over the coming five years for expansion of operations across business segments, of which the company plans to invest Rs 45,000 crore (US$ 6.18 billion) in the petrochemicals segment.

- Reliance Industries Ltd (RIL), along with its partner BP plc, has decided to invest US$ 6 billion for the development of new R-series gas field.

- Energy Infrastructure (EIL), a subsidiary of the Netherlands-based Energy Infrastructure Butano (Asia), to set up a LPG terminal in Gujrat with an investment of Rs 700 crore.

- World’s largest oil exporter Saudi Aramco is planning to invest in refineries and petrochemicals in India as it looks to enter into a strategic partnership with the country.

- ONGC is going to invest Rs 17,615 crore on drilling oil and gas wells in 2018-19.

- State-run oil firms are planning investments worth Rs 723 crore in Uttar Pradesh to improve the LPG infrastructure.

- The Oil Ministry plans to set up bio-CNG plants and allied infrastructure at a cost of Rs 7,000 crore (US$ 1.10 billion) to promote the use of clean fuel.

Shivam Daga

MBA-FA(2018-20)

No responses yet